Tax Form For Retirement Contribution . 62 rows find the forms, instructions, publications, educational products, and other related information useful for. Eligible plans to which you can make. If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the.

from www.formsbank.com

If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. Eligible plans to which you can make. To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. 62 rows find the forms, instructions, publications, educational products, and other related information useful for.

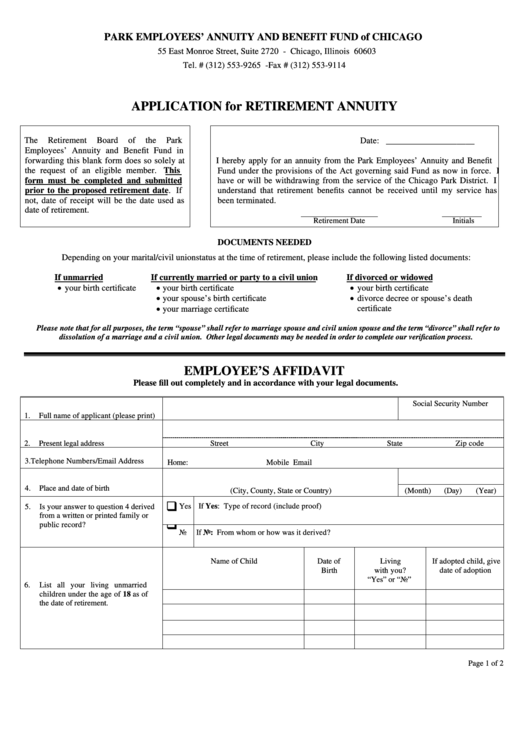

Application For Retirement Annuity printable pdf download

Tax Form For Retirement Contribution The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. 62 rows find the forms, instructions, publications, educational products, and other related information useful for. Eligible plans to which you can make. If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the.

From map.cpa

Plan Your 2021 Retirement Contributions Mangold Anker Phillips CPA Tax Form For Retirement Contribution If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. 62 rows find the forms, instructions, publications, educational products, and other related information useful for.. Tax Form For Retirement Contribution.

From patch.com

IRS Raises Retirement Plan Contribution Limits for 2015 Winchester Tax Form For Retirement Contribution If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. Irs form 8880 calculates how much of a tax credit you may qualify for if. Tax Form For Retirement Contribution.

From www.formsbank.com

Form Sc Sch.tc29 Qualified Retirement Plan Contribution Credit Tax Form For Retirement Contribution To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. 62 rows find the forms, instructions, publications, educational products, and other related information useful for. Eligible plans to which you can make. If you contribute to an individual retirement account (ira), there’s a tax form you should get. Tax Form For Retirement Contribution.

From psu.pb.unizin.org

Using 401(k) Retirement Money for Seed Funding Entrepreneurship Law Tax Form For Retirement Contribution 62 rows find the forms, instructions, publications, educational products, and other related information useful for. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. Eligible plans to which you can make. Irs form 8880 calculates how much of a tax credit you may qualify for. Tax Form For Retirement Contribution.

From hsaedge.com

HSA Employer Contributions on W2 Box 12 "W" HSA Edge Tax Form For Retirement Contribution Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Eligible plans to which you can make. To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. Generally, you are covered by a defined contribution. Tax Form For Retirement Contribution.

From earlyretirement.netlify.app

Retirement forms Early Retirement Tax Form For Retirement Contribution 62 rows find the forms, instructions, publications, educational products, and other related information useful for. If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k).. Tax Form For Retirement Contribution.

From sheetsiq.com

Free Retirement Tax Template Google Sheets SheetsIQ Tax Form For Retirement Contribution Eligible plans to which you can make. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. 62 rows find the forms, instructions, publications,. Tax Form For Retirement Contribution.

From www.pdffiller.com

Fillable Online Employee PreTax Retirement Contribution Agreement Form Tax Form For Retirement Contribution Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Eligible plans to which you can make. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). If you contribute to an individual. Tax Form For Retirement Contribution.

From studentaid.gov

2020 W2 form with boxes 12a through 12d outlined Tax Form For Retirement Contribution To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in. Tax Form For Retirement Contribution.

From www.marottaonmoney.com

2013 IRA & Roth Contribution Limits Marotta On Money Tax Form For Retirement Contribution Eligible plans to which you can make. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. 62 rows find the forms, instructions, publications, educational products, and other related information useful for. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds. Tax Form For Retirement Contribution.

From www.pinterest.com

4 tax forms retirees need to gather and examine closely before filing Tax Form For Retirement Contribution Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds. Tax Form For Retirement Contribution.

From www.formsbirds.com

Form 5305ASEP Individual Retirement Accounts Contribution Agreement Tax Form For Retirement Contribution Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). To claim a deduction for your personal super contributions, you must give your. Tax Form For Retirement Contribution.

From www.thebalancemoney.com

How to Calculate Taxes on Retirement Tax Form For Retirement Contribution Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Eligible plans to which you can make. The taxes you owe on your 401(k) distributions at retirement depend on whether your funds are in a traditional 401(k) or a roth 401(k). If you contribute to an individual. Tax Form For Retirement Contribution.

From accuracy-plus.ca

Defined Contribution vs. Benefit Pension Plan for Employees Accuracy Tax Form For Retirement Contribution To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. The taxes you owe on your 401(k) distributions at retirement depend on whether your. Tax Form For Retirement Contribution.

From www.formsbank.com

97 Retirement Forms And Templates free to download in PDF Tax Form For Retirement Contribution To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. 62 rows find the forms, instructions, publications, educational products, and other related information useful for. If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. The taxes. Tax Form For Retirement Contribution.

From www.formsbank.com

Application For Retirement Annuity printable pdf download Tax Form For Retirement Contribution If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Eligible plans to which you can make. 62 rows find the forms, instructions, publications, educational products, and other related information useful for. To claim a deduction for your personal super contributions, you must give your super fund a notice. Tax Form For Retirement Contribution.

From www.formsbank.com

17 Retirement Plan Form Templates free to download in PDF Tax Form For Retirement Contribution Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the. To claim a deduction for your personal super contributions, you must give your super fund a notice in the approved form and. Irs form 8880 calculates how much of a tax credit you may qualify for. Tax Form For Retirement Contribution.

From www.formsbirds.com

Form 5305SEP Simplified Employee PensionIndividual Retirement Tax Form For Retirement Contribution If you contribute to an individual retirement account (ira), there’s a tax form you should get familiar with — form 5498. Irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. To claim a deduction for your personal super contributions, you must give your super fund a. Tax Form For Retirement Contribution.